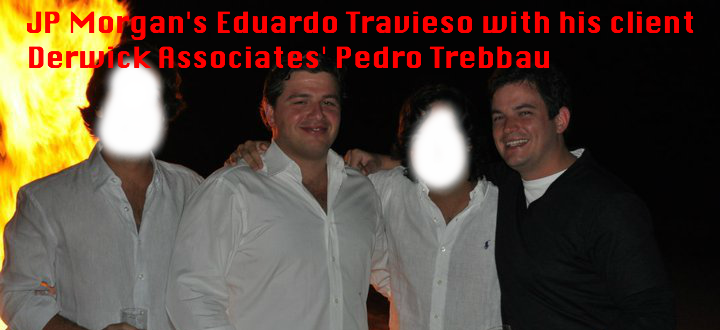

[caption align=right] JP Morgan's Eduardo Travieso (left) hard at work with Derwick Associates' Pedro Trebbau[/caption] Now that I have had time to go over the lawsuit filed by Otto Reich against Derwick Associates' "ChavezKids" (aka Bolichicos), the first thing that caught my eye was to learn about a chap called Eduardo Travieso, formerly with JP Morgan. I have evidence that Mr Travieso had more than just a professional relationship with Derwick Associates' executives. They party together and even went to the same school in Caracas. In addition, a source has indicated that Travieso was receiving significant wires from Derwick, then buying bonds, and almost immediately selling the bonds and wiring the money out of the account. Travieso is mentioned in the claim's particulars:

JP Morgan's Eduardo Travieso (left) hard at work with Derwick Associates' Pedro Trebbau[/caption] Now that I have had time to go over the lawsuit filed by Otto Reich against Derwick Associates' "ChavezKids" (aka Bolichicos), the first thing that caught my eye was to learn about a chap called Eduardo Travieso, formerly with JP Morgan. I have evidence that Mr Travieso had more than just a professional relationship with Derwick Associates' executives. They party together and even went to the same school in Caracas. In addition, a source has indicated that Travieso was receiving significant wires from Derwick, then buying bonds, and almost immediately selling the bonds and wiring the money out of the account. Travieso is mentioned in the claim's particulars:

At all relevant times, Defendants' personal banker at J.P Morgan was Eduardo Travieso ("Travieso"), a Vice President in the Private Banking Division who was located in New York, New York. On March 21, 2013, according to a required U.S. regulatory filing with FINRA, Travieso separated from J.P. Morgan following allegations that Travieso had potentially committed violations of investment-related statutes, fraud, or failure to supervise in connection with investment-related statutes, arising from certain undisclosed customer interactions by Travieso. In the filing, J.P.Morgan has stated publicly that "Mr.Travieso acted in a manner that is inconsistent with the Firm's policies and procedures," and had "fallen short of the standards" of financial industry employees.

Despite whatever problem that Travieso may have had with JP Morgan, he continues to claim -through his LinkedIn page- that he is currently "Vice President at JP Morgan". On the other hand, the lawsuit quotes FINRA, in whose "Brokercheck" page one can read that Travieso is "Not registered with FINRA since 04/2013". FINRA's report on Travieso doesn't help much in dispelling doubts as per his propriety. But all this caught my attention for since I started exposing Derwick Associates, JP Morgan's staff out of a New York office keep visiting my blogs with regularity. Furthermore, I have evidence that staff at JP Morgan, or someone with access to their computers, have been searching the web for information related to corruption involvement by Leopoldo Alejandro Betancourt Lopez and Pedro Jose Trebbau Lopez, two of the three defendants in Reich's lawsuit.

JP Morgan apparently terminated its relationship with Travieso. But the questions remain: how much of Derwick Associates ill gotten money did JP Morgan, knowingly or unknowingly, launder? Who supervised Travieso? Who were his superiors? How many millions did Derwick wire through JP Morgan to pay American subcontractors and/or companies such as ProEnergy Services and FTI Consulting? Were Al Cardenas' and Hector Torres' services to Derwick also paid from their JP Morgan account? Is JP Morgan expecting people to believe that Travieso moved millions of dollars without anyone noticing, without any superior vetting his "deals"? What KYC did JP Morgan do on Derwick Associates? What due diligence? Or were AML, FCPA and all relevant regulations/legislation simply ignored -as is often the case for banks nowadays- in order to increase revenue thanks to utterly corrupt "businessmen" from banana republics?

FINRA reports JP Morgan as claiming: "Mr. Travieso acted in a manner that is inconsistent with the firm's policies and procedures and may have violated applicable regulatory requirements, including using his residential address as the mailing address for certain customer communications. Mr. Travieso's conduct has accordingly fallen short of the standards to which the firm holds its registered representatives."

I sure hope this case exposes Derwick Associates and its American partners, for I am really keen on hearing what sort of spin these dodgy bankers will put on it.