Notice mention to Paulo Nacif below:

"Outro acordo com o venezuelanos detectado pelo Ministério Público data de 2014, ano em que a ESAF, entidade do grupo BES, passou a gerir, durante seis anos, o fundo de pensões dos trabalhadores da PDVSA, avaliado em 3550 milhões de dólares. O negócio foi adjudicado depois de vários contactos entre o próprio Ricardo Salgado, dois homens fortes do BES Madeira (João Alexandre Silva e Paulo Nacif) e Rafael Ramírez, presidente da empresa e ministro do Petróleo da Venezuela à data."

The above is related to $106 million bribe payments that Banco Espirito Santo thug-in-chief Ricardo Salgado paid to Rafael Ramirez's associates / collaborators to manage PDVSA funds. Hold that thought for a moment, and read below instructions that Paulo Nacif emailed to Pablo Custer and Joao Alexandre Silva on 21 March 2012:

From: PAULO NACIF (BES-SFE-MADEIRA DIRECCAO CORPORATE)

Sent: Mittwoch, 21. März 2012 17:16

To: Custer, Pablo; JOAO ALEXANDRE SILVA (BES-SFE-MADEIRA DIRECCAO GERAL)

Subject: PDVSA >> Wire Transfer of USD 230.000.000 is providing now

Importance: High

Dear Pablo,

We would like to inform you that BES is providing today a wire transfer ordered by PDVSA of the amount of USD 230,000,000.00.

Kind regards,

Paulo Nacif

Director

Banco Espirito Santo, S.A. - Madeira Branch

International Corporate Banking Americas

Rua Braamcamp, 2 - 5th Floor 1250-050 Lisbon, Portugal

Tel.: +351 21 883 4579 Mobile: +351 96 110 2833

E-mail: paulo.nacif@bes.pt

Who is Pablo Custer? Together with Dieter Staeubli, personal banker of Violet Advisors -recipient of wire- at EFG Bank. Who is Violet Advisors? Ignacio and Luis Oberto Anselmi, but also Francisco Convit, Pedro Trebbau, and Leopoldo Alejandro Betancourt Lopez (Derwick Associates) according to documents seen by this site.

In fact, an EFG Bank internal report of an "External visit to Caracas with Ignacio O., Francisco C., Leopoldo B." on 21 February 2013, refers to Oberto, Convit and Betancourt as members of a client group with whom discussion pertaining to evolution of portfolios and service satisfaction levels were had.

Elsewhere, the Oberto brothers are described as close associates of Raul Gorrin and Gustavo Perdomo, also EFG Bank clients.

According to EFG Bank internal documents "during 1H2012 these clients conducted very profitable transactions (through EFG) in the amount of of approx USD 1.5 Billions. At least the same amount (probably more!) was transacted through other banks (i.e. CBH Geneva)."

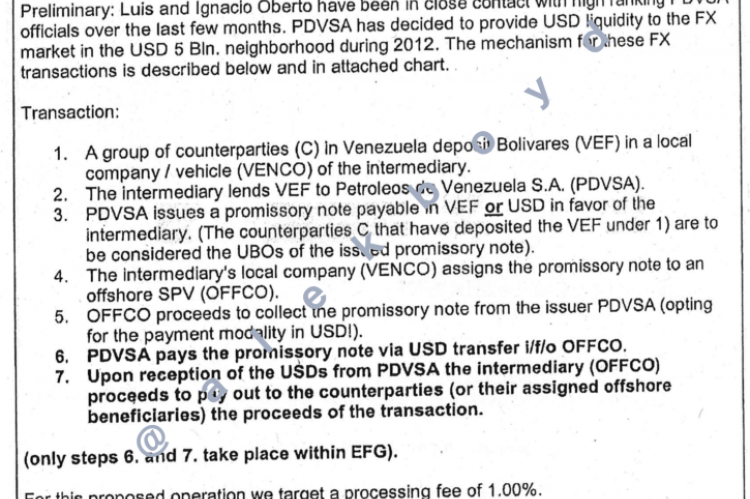

Internal EFG Bank documents describe what Gorrin, Perdomo, the Obertos, Convit, Trebbau and Betancourt were doing with PDVSA. A "reputation risk" report claims "PDVSA has decided to provide USD liquidity to the FX market in the USD 5 Bln. neighborhood during 2012."

In "Other Comments" of same report, EFG claims "During 2009 we have processed FX swaps in excess of USD 1 Bln where PDVSA was the USD supplier and Banco Activo, C.A. (account 583252) the operator / intermediary." Legal justifications for these transactions was provided by the "Caracas office of Baker & McKenzie". The Obertos are described as "high quality counterparties". Pedro Binaggia is also mentioned as a constant source of "very profitable business since early 2009." Raul Gorrin and Gustavo Perdomo shells (Vineyard Ventures and Mahogany Commercial S.A.) are also mentioned throughout in connection to the Obertos.

Back to the Banco Espirito Santo email, Violet Advisors' EFG account 584684 received $1 billion worth of PDVSA transfers between 21 March and 11 April 2012:

- $230,000,000 on 21 March;

- $270,000,000 on 28 March;

- $175,000,000 on 2 April;

- $325,000,000 on 11 April.

Of that $1bn pool and in the same timeframe, Derwick Associates-related shells controlled by Convit, Trebbau and Betancourt (Minenven, Delphi, Julotti, Zoletto, Imminvest, IPC Investments, Vecon, and Sinfin) got from Violet Advisors 10% worth ($100,000,000) into accounts held in Bank Frey, Compagnie Bancaire Helvetique, HSBC, and Julius Baer.

The Obertos also seem to be associated to Derwick Associates' partnership with Gazprom at PDVSA / Gazprom joint venture Petrozamora. A presentation made by Santina Restifo -with Seguros Venezuela (Oberto's insurance company) and BBO Financial Services (Obertos' daddy's very own bank)- and seen by this site, suggests the Obertos might own 8% of Derwick's 49.44% stake in Gazprombank Latin America Ventures, the Amsterdam shell incorporated by Gazprom to partner with PDVSA in Petrozamora.

So the question is: why if Raul Gorrin and his crew have been sanctioned in connection to Matthias Krull (indicted / charged) and Francisco Convit (indicted / declared fugitive) money laundering scandal at PDVSA, Luis and Ignacio Oberto continue to live in Miami as if they did nothing? Remember the above refers to money laundering transactions in March / April 2012 at EFG Bank.

Then there's Meinl Bank, and through Compagnie Bancaire Helvetique, as per EFG Bank and confidential sources, the Obertos / Ramirez did another $2.75 billion worth of a $4.25 billion total. And yet, the architects of that other tranche of the scam (Obertos, Rafael Ramirez, Charles Henry de Beaumont, Joseph Benhamou and Danilo Diazgranados) are still to be indicted.

Is this a case of some criminals being more equal than others? This is just one exhibit of the sort of business that Rafael Ramirez conducted at PDVSA.