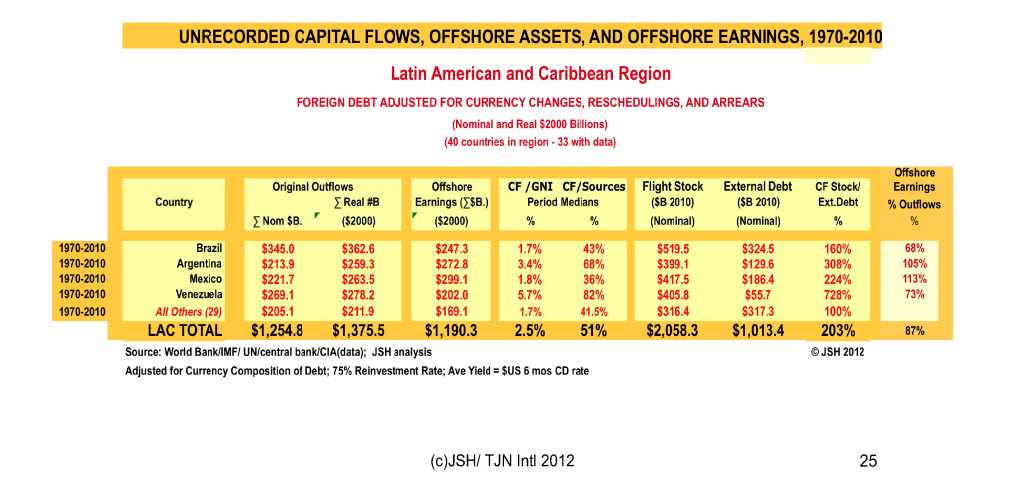

Reading El País the other day, I came across an article with a bold claim about capital flight: Venezuelans had $405.8 billion stashed abroad. In all honesty, I was incredulous, shocked, having never looked at such figures. Given that the article did not specify methodology used, period, and data sources, I decided to dig a little and got to the original source: James S. Henry from Tax Justice Network. Before getting down to explain Mr Henry's methodology, let me place here the chart from where El País claim originated:

The chart above comes from this presentation, which in turn is an annex of a paper entitled "The Price of Offshore Revisited" authored by Henry. It is, for those of us with an interest in corruption, a fascinating work. In his paper, Henry explains methodology used as:

(1) a "sources-and-uses" model for country-by-country unrecorded capital flows;(2) an "accumulated-offshore-wealth" model; (3) an "offshore-investor-portfolio" model; and (4) direct estimates of offshore assets at the world's top 50 global private banks.

I called Henry to ask about his numbers. The conversation started with the claim that offshore is basically a blackhole, and that there are no direct figures. I think we can all agree on that. The set of data comes from: 1) the Bank of International Settlements (BIS), which produces a series on "cross-border loans from BIS reporting banks" as well as another for "cross-border loans from BIS banks to non banks" among others, interviews with private bankers, reports by "non banks" on managed and unmanaged assets; 2) reports of assets under management from world's top 50 banks; and 3) sources-and-uses, a method employed since the 70ies, which estimates borrowing abroad - external debt with direct foreign investments and portfolio investments (sources), and contrasts it with current account and trade deficits, and reserves (uses), which should, in theory, cancel each other out.

In reality, however, it doesn't. Henry says there's a huge difference, and therefore capital flight estimates.

I am no economist, and I make no claim to be an expert in the field. However, I can only but agree with Henry in that this capital flight / offshore wealth thing is, at best, a conservative guesstimate. Mainly because the data is unreliable. The World Bank, the IMF and the BIS (all three sources used by Henry) can only report what their members report to them in turn. That, in my opinion, has an evident disadvantage. In the case of Venezuela, for instance, unaudited numbers from chavista-controlled institutions do not reflect reality. In fact, there were reports in the blogosphere recently, about last time Venezuela complied with IMF's financial assessments requirements: 13 September 2004. As Fausta aptly put it: "The Venezuelan government has not allowed its own numbers to be verified for almost a decade."

I'll give another notorious and famous example: poverty decreased in Venezuela 11% overnight, after Hugo Chavez called the chair of the National Statistics Institute (INE) to order a revision of reported figures.

If to that, we add reports from banks that -for obvious tax reasons- under report managed wealth and assets owned by clients, we get to a picture that bears little resemblance with reality.

Despite its amount, the $405.8 billion estimate for the period 1970-2010, may well be short. It is just a bit over $10 billion / year. The period includes Venezuela's two episodes of extraordinary oil income (1970ies and 2000s). When one considers that the currency-control institute (CADIVI) awarded $20 billion to fly-by-night companies in 2012 only, one can see the size of the fiscal hole that corruption can create, in just one institution in a single year. Multiply that over a sprawling, largely unregulated State apparatus, over 40 years, and $405.8 billion becomes a very conservative guesstimate indeed. The combined GDP of Venezuela, since 1999 alone, is nearly $3 trillion...