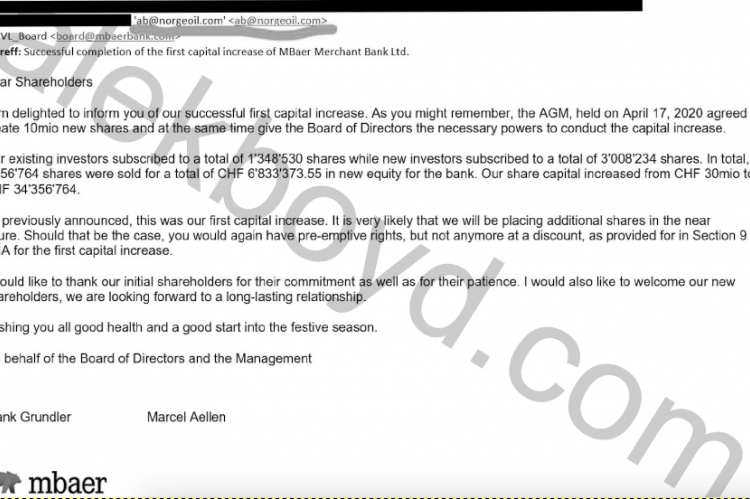

Quoting from source: "MBaer Merchant Bank AG is majority-owned by Swiss investors, while other groups of shareholders are based in Asia and the Middle East. The shareholders include numerous private investors, above all entrepreneurs who are also our clients and are themselves widely connected." [bold added] Frank Glundler is the Chief Compliance Officer of Mbaer Merchant Bank AG. Dr. Marcel Aellen is described as "Chairman of the Board of Directors of MBaer Merchant Bank since September 2020 and was previously Deputy Chairman since December 2018. He specializes in the areas of regulation and supervision as well as audit, risk control and compliance." This site has seen an email sent by Glundler and Aellen (Betreff: Successful completion of the first capital increase of MBaer Merchant Bank Ltd.), wherein an email address associated with U.S. Treasury-designated Alessandro Bazzoni is included among CC recipients. And so we ask: what could possibly have prompted Glundler and Aellen to include Bazzoni in confidential communications regarding MBaer's "successful" capital increases?

Bazzoni's wife, Siri Evjemo-Nysveen, is MBaer's "Vice Chairwoman of the Board of Directors... since September 2020. She has a specialist focus on regulatory frameworks and supervision and audit, risk control and compliance." This site could not find similar positions held in the past by Evjemo-Nysveen. Her LinkedIn has references to one analyst role, and four other positions in the past, in equity sales. Never board level. Like Glundler and Aellen, Evjemo-Nysveen claims expertise in "regulatory frameworks and supervision and audit, risk control and compliance." They're all experts in risk control and compliance there at MBaer.

Let's go back to Glundler and Aellen's email: "I am delighted to inform you of our successful first capital increase. As you might remember, the AGM, held on April 17, 2020 agreed to create 10mio new shares and at the same time give the Board of Directors the necessary powers to conduct the capital increase. Our existing investors subscribed to a total of 1 '348'530 shares while new investors subscribed to a total of 3'008'234 shares. In total, 4'356'764 shares were sold for a total of CHF 6'833'373.55 in new equity for the bank. Our share capital increased from CHF 30mio to CHF 34'356'764." [bold added]

Communication to shareholders, about successful round, took place 30 November 2020. This site could find no records of Evjemo-Nysveen's roles at MBaer -on any capacity- before increase of share capital referred to by Glundler and Aellen's email to shareholders. It could be that her email address didn’t work, hence reason why hubbie Bazzoni was copied.

In any case, given that Bazzoni was recently sanctioned by Treasury for his involvement with Alex Saab, this site put questions to him, to Glundler and Aellen, to MBaer's Board and to FINMA. As of this writing, none have replied.

MBaer's disclaimer page contains the following: "In particular, the offering of MBaer Merchant Bank AG is not directed at persons domiciled in the United States, Canada, the UK or Germany." Bazzoni and Evjemo-Nysveen live in the UK, have companies in the UK, read emails from the UK, and play in the Royal Family polo club whose members wronged poor Meghan. It could be that Bazzoni has, also, been unjustly wronged by U.S. Treasury, and all of his businesses with the Western Hemisphere most corrupt regime are kosher.

The question as to why is he included in MBaer's internal communications remain though. The question as to what kind of due diligence was done on Evjemo-Nysveen is also pertinent, as it is their use of an Isle of Man shell (Norge Oil) as subterfuge to hide stake.

This site revealed minority stake that Alejandro Betancourt and Francisco Convit held at Credinvest. FINMA, eventually, caught up with the news, but did nothing. We also revealed Danilo Diazgranados purchase of Compagnie Bancaire Helvetique shares, which FINMA is yet to address. In the case of MBaer and Bazzoni, we don't hold our breath. FINMA's absolute inefficiency notwithstanding, Bazzoni and his Venezuelan partners remain sanctioned. Alex Saab is not only Nicolas Maduro's favourite operative: Saab's partner has been a person of interest for the DEA due to his drug trafficking activities and sentence (in Italy); Saab is also a Treasury sanctioned individual and was indicted and charged by DoJ for corruption and money laundering, which in this site's opinion, is exactly what MBaer is doing for Bazzoni.