The case of Nynas qualifies as one of the most brazen corporate raids seen in Venezuelan owned assets. Before Trump administrations' sanctions, PDVSA was Nynas' majority shareholder with a stake of over 50%. The rest was owned by Finland's Neste group. Treasury sanctions on PDVSA caused a great deal of disruption, which pushed Nynas to the brink of bankruptcy. A completely rigged reorganisation process followed, whereby representatives of GPB Global Resources BV (Alejandro Betancourt, Francisco Convit, Boris Ivanov, Vladimir Anisimov) not only illegally appointed legal counsel on PDVSA's behalf, but managed to get preferential treatment among creditors.

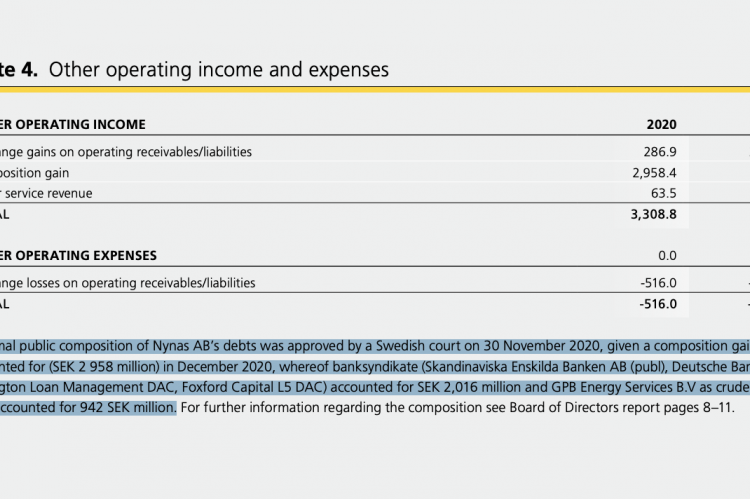

Sources reported that a mezzanine loan given to Nynas by Betancourt and outstanding debt owed to Petrozamora (joint venture formed by Betancourt, Ivanov and co with PDVSA, which was Nynas' largest crude provider), guaranteed GPB's seat at the reorganisation table. Treasury sanctions forced PDVSA to shed 35% of the 50%+ it had into a nondescript vehicle (Nynässtiftelsen or NyColleagues AB), controlled by Nynas' management. GPB and large institutional creditors (banks) were dealt with, while Neste's 49% -which had written off its Nynas' stake- was acquired by a shell called Bitumina Industried Ltd, which would file for bankruptcy in London shortly after.

Davidson Kempner entered the fray, acquiring banks' debt and Bitumina's 49% at a massive discount, becoming Nynas's largest shareholder in the process. Aside from preferential "subordinated hybrid instruments... (treated as equity)" and 49% stake, remaining 35% in Nynässtiftelsen and 15% in PDVSA (PDV Europa B.V.), must have gotten diluted somehow: PDVSA no longer has a seat on Nynas' Board. PDVSA's last representative was Oswaldo Perez (Vice President Finance at PDVSA).

Nynas got rid of information of its Board of Directors altogether from its website. Its last reported accounts, as per website, are for 2020. It is evident that PDVSA is no longer involved in any meaningful way with Nynas, neither at the executive level nor as a crude provider. The questions are: what happened to its 15% stake? What about Nynässtiftelsen's 35%? Is Nynässtiftelsen's stake tied to PDVSA? How does PDVSA exercise its rights at Nynas? How come it no longer appoints representatives to Nynas' Board?

In the context of Vladimir Putin's war of aggression against Ukraine, it bears recalling that GPB, under its different guises, is a Treasury sanctioned entity since 2014. It is also worth repeating that Francisco Convit, a GPB associate, is a Justice Department fugitive. His partner Betancourt, is part of several ongoing criminal probes. Vladimir Anisimov has been for decades associated / employed by Nikolay Patrushev, while Boris Ivanov's diplomatic past and associations with Gazprom are just the right credentials necessary to enter Treasury's sanctions list.

All of the above was, and continues to be, ignored by Swedish and American authorities.