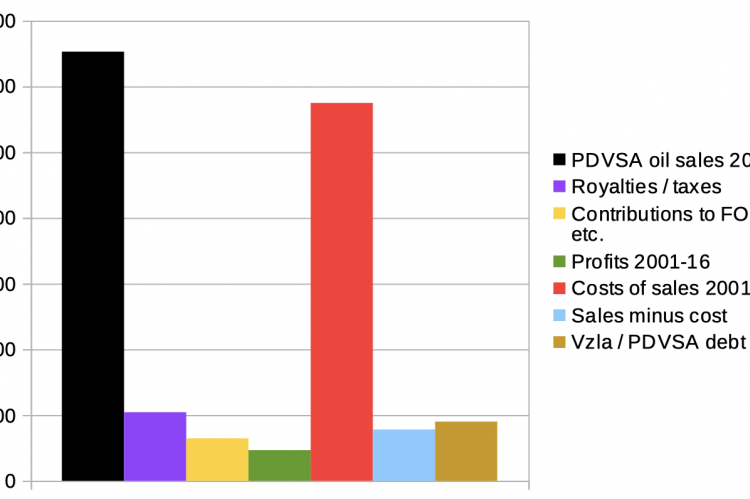

$1,305,592,000,000 (please have this number in mind -one trillion, three hundred and five billion, five hundred and ninety-two million dollars- as you read through). Two very charitable chaps from Cleary Gottlieb, Richard J. Cooper and Mark A. Walker, have published a paper on Venezuela's debt, entitled "Venezuela's Restructuring: A Path Forward" (see below with added comments). It is work that shows the kinds of problems a future administration will have to deal with ($191.4 billion debt) in terms of pleasing the country's creditors.

In short, Cooper and Walker argue that a) there's two kinds of creditors -those holding PDVSA debt and those holding Venezuela debt; b) that these creditors are further divided along those who are willing to participate in a restructuring plan proposed, and "recalcitrant creditors" otherwise known as "vulture investors" that won't participate in such a plan; c) that a sandwich of U.S. de-sanctioning measures and Venezuelan favourable new legislation ought to be created; d) that such Venezuelan new legislation ought to be drafted by a committee of folks keen to listen to creditors' proposed plan; e) that measures to deal with "burdensome or illegitimate contractual undertakings" should be considered; f) that foreign Venezuelan assets ought to be ring-fenced; g) that swap options -either for new debt or equity- ought to be considered; and h) that further incentives ought to be offered to creditors during restructuring discussions.

I decided to describe Cooper and Walker as charitable. Their "elegant and valuable" proposal is little more than a road map to discriminate between bondholders they represent -willing to play ball and carry on milking Venezuela's tit- and those who don't.

Maduro is meant to have caused the problem, read obligations on both PDVSA and Venezuela debt have been all but abandoned, though it is worth asking: how much have these charitable chaps and their clients already gotten since Maduro got to power in 2013? Was any restructuring plan put forward by these bondholders prior to practical de facto default? Did these charitable fellas ever consider how burdensome would it be for Venezuela and PDVSA to be issuing debt like there was no tomorrow in the middle of an oil boom?

$1,305,592,000,000. That's how much PDVSA got in oil sales between 2001 and 2016. There was no question then on Hugo Chavez and Nicolas Maduro ability to service new debt. It was a piñata, in which all of these very considerate and sympathetic investors partook with abandon.

How utterly hypocritical it is now to be arguing that this set of investors is more worthy than that, or whether this deal was legitimate and that wasn't. All $191 billion of it was burdensome. All of it was questionable. All of it unsustainable. In light of over $1.3 trillion worth of income, there was no need to issue fresh debt. None. Quite the contrary, all debt should have been paid, and had Venezuela's political class had a shred of foresight the country could be sitting, debt-free with a pile of money in a sovereign fund, like Norway.

I consulted an expert well versed on the topic. His take is that those represented in the proposal are "petrified that PDVSA will be worth nothing", in the event that a new administration decides to wind that entity down. That's a consideration already contemplated by the Maduro regime BTW (CAMIMPEG). Putting PDVSA and Venezuela debt on same legal footing is "bogus", and "in the end, PDVSA creditors should get nothing", a view with which this site wholeheartedly agrees.

Consulted expert claimed that proposal represented the views of Fidelity, Goldman Sachs, GMO, T. Rowe Price, Greylock, Ashmore and Pimco.

What is evident from the paper, is that in a rather infantile and totally untenable manner a distinction between good and bad creditors, and responsible v burdensome / unsustainable debt, is attempted. Those in Cleary Gootlieb's camp should be treated with silk gloves by a possible new administration in Venezuela (good luck with that), and future U.S. administrations. Old canard of lifting sanctions regime is also included for good measure, and fresh opportunities for phenomenal corruption are instrumental in Cooper and Walker little plan. However many olive branches are offered to boligarchs, Guaido & co, China, Putin, etc., we are of the opinion that if there's one certainty about Venezuela's creditors' future, is that it will be very messy indeed. This site hopes that commensurate to responsibility degree in current mess, these charitable folks get properly burnt.