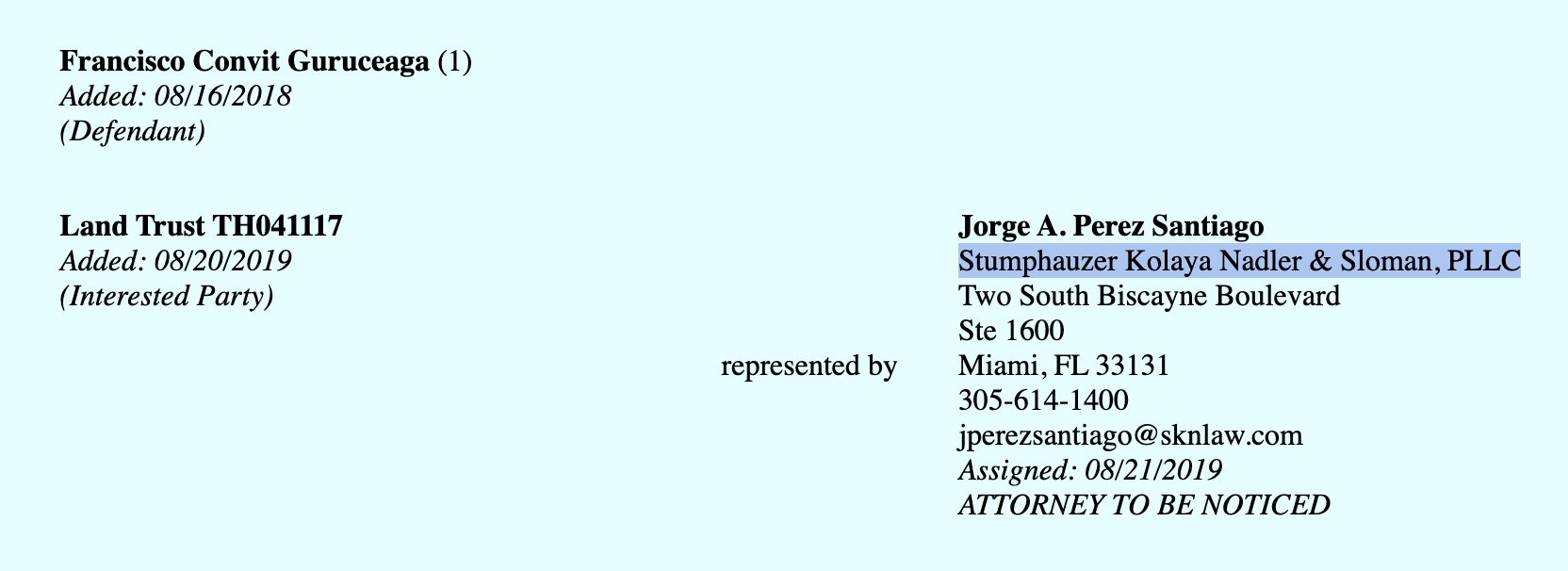

In the tranquil shores of Lac Léman, Switzerland's Supreme Court issued in December of last year two new rulings against Derwick Associates: the criminal enterprise set up by Alejandro Betancourt, Francisco Convit and Pedro Trebbau. Gotham City reports today that the Supreme Court rejected appeals filed by shell companies linked to Betancourt and Convit that sought to impede sending incriminating information to the U.S. Department of Justice. The shells in question are IPC Investments Corp., Derwick Oil and Gas Corp., and Vencon Holdings Investment Inc.

This is not the first time Switzerland's Supreme Court finds against Derwick Associates in relation to a money laundering scheme that syphoned over $4 billion from PDVSA.

Betancourt's and Convit's appeals in Switzerland are immaterial at this point. The information that provides indisputable evidence of Derwick's participation in the scheme reached probing authorities a long time ago.

EFG Bank's compliance documents, wire transfers and other internal documents that show how the main orchestrators of the scheme (Luis and Ignacio Oberto Anselmi through Violet Advisors) received billions of dollars worth of payments from PDVSA -a part of which were immediately transferred to accounts controlled by Betancourt and Convit- were hand delivered to the Department of Justice, many years before Derwick Associates started fighting Swiss authorities in that regard.

EFG Bank reported all transactions above 10,000 Swiss Francs done by Violet Advisors. Among evidence of payments wires to Calandra Business, Banstead Assets, Minenven, Delphi, Julotti, Zoletto, Imminvest, IPC Investments, Vecon, and Sinfin (all controlled by Betancourt and Convit) were provided.

Another batch of internal documents from Compagnie Bancaire Helvetique was also given to Florida prosecutors leading the probe. Among the documents there was evidence of how Compagnie Bancaire Helvetique acquired -on Betancourt's and Convit's behalf- bearer shares shell companies in Panama and other jurisdictions, opened bank accounts, granted and got powers of attorney, and managed proceeds generated by the scheme while decidedly ignoring its corrupt origin. Compagnie Bancaire Helvetique's CEO (Joseph Benhamou) personally got millions of dollars in commissions for his services.

FinCEN's declaration against Banca Privada D'Andorra -a money laundering concern- resulted in yet more evidence linking Betancourt and Convit to the Oberto Anselmi brothers' money laundering scheme having been made available to American law enforcement.

It is not lack of evidence available to prosecutors what has prevented Betancourt and Convit from joining the likes of Alex Saab in a Florida prison, but rather their very shrewd strategy of retaining former Department of Justice prosecutors, U.S. Attorney General, National Security Council officials, and even Donald Trump's personal lawyer. Billions stolen from Venezuela continue to line the pockets of Derwick's advocates.

The U.S.A. is the only jurisdiction investigating and charging Venezuelan white collar criminals. The U.S. legal system is also unique in the sense that people involved in criminal activity can, at any point, enter into "collaboration agreements" with probing authorities that often end up in almost total exonerations.

As long as Betancourt and Convit refrain from visiting, or continue playing the "collaboration" card, they have nothing to fear. Same applies to the Oberto Anselmi brothers and all others involved.