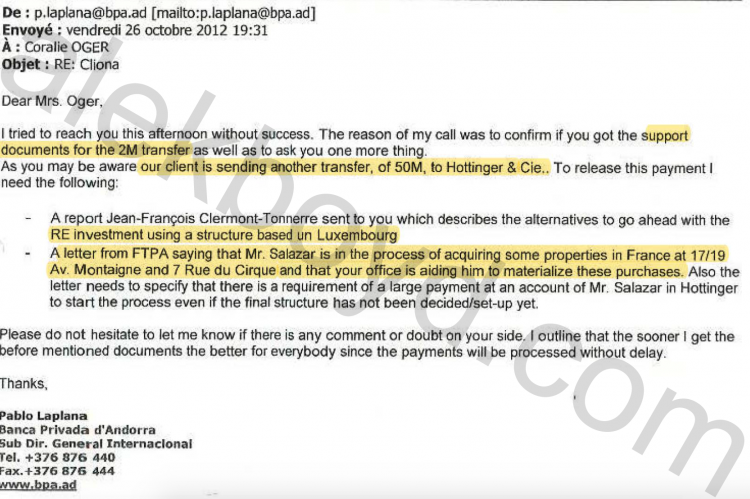

Diego Salazar is this unpresentable thug whose only redeeming and unearned feature is to have a first cousin called Rafael Ramirez. Ramirez was President of PDVSA and Venezuela's Minister of Energy for over a decade, during which he ensured that his closest family and collaborators were given plenty of opportunities for corruption. As PDVSA CEO, he forced Diego Salazar as main intermediator between Chinese companies receiving billions worth of procurement contracts from Venezuela and PDVSA. One exhibit is Sinohydro. But there are many more. With "earned" profits, Salazar set to grow his property portfolio in many places, and in Paris, he got his Banca Privada d'Andorra (BPA) banker money launderer Pablo Laplana to liaise with Coralie Oger, a lawyer from FTPA.

Lawyers, as we know, are a third the money laundering problem (the other two thirds being equally corrupt bankers and useless financial watchdogs). Oger's expertise is described as "Corporate Law and Mergers and Acquisitions, and in particular in international and domestic Mergers & Acquisitions, Restructurings and LBO and Private Equity transactions."

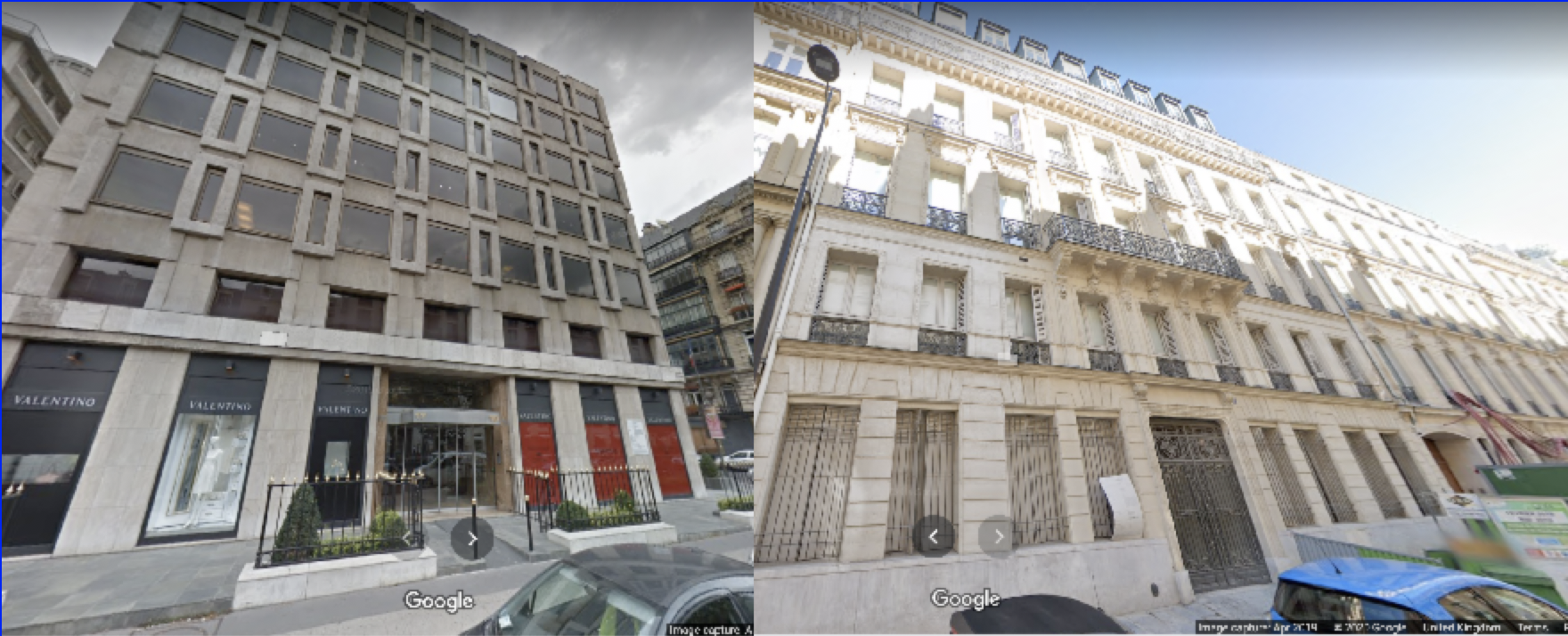

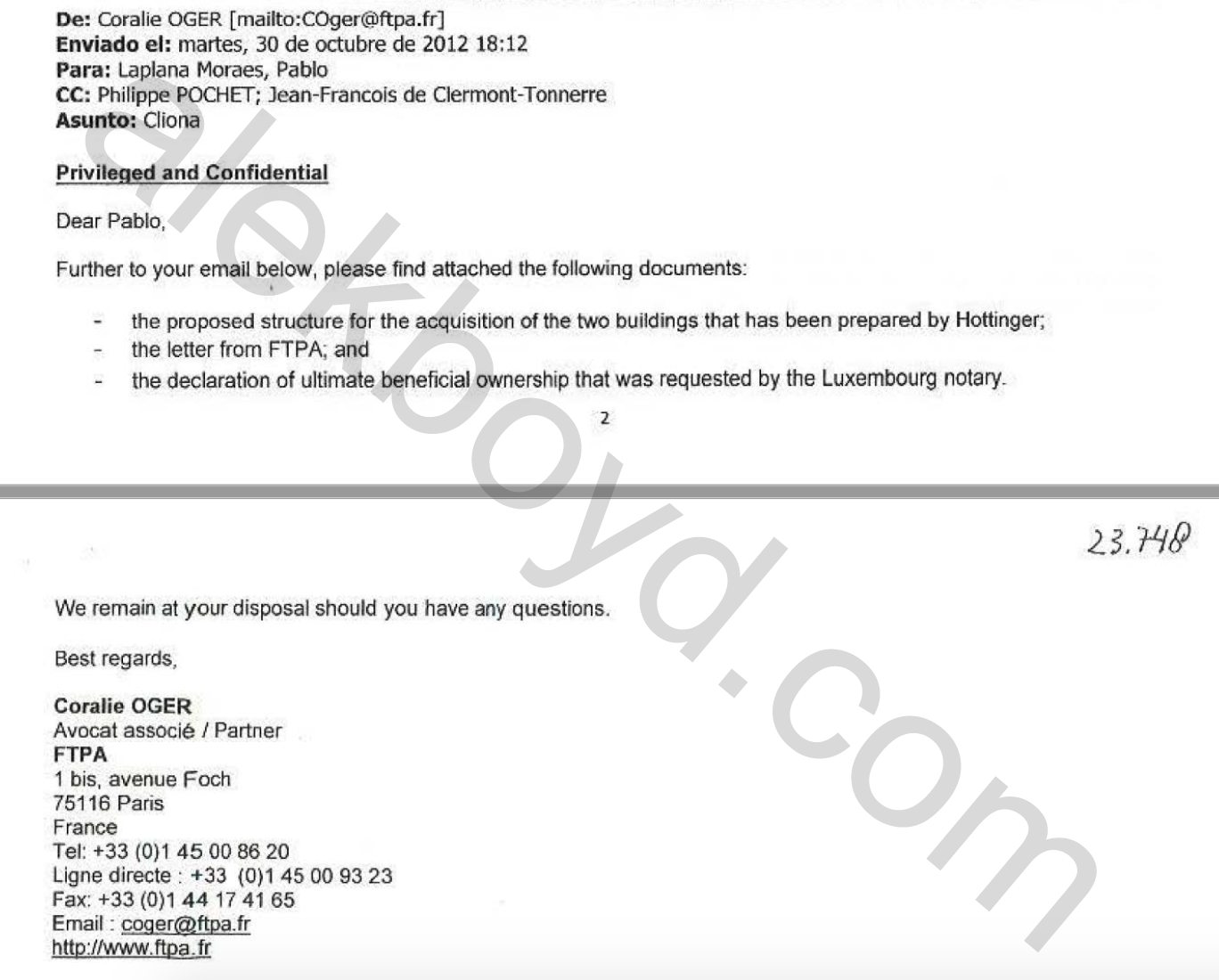

So when thug Diego Salazar needed to diversify his "private equity" through non-descript structures, Oger assisted him with creation of a Luxembourg vehicle that would obscure the ultimate beneficiary owner of two buildings -worth €50 million- located in 17/19 Av. Montaigne and 7 Rue du Cirque in Paris.

Oger was not acting without approval from the top at FTPA. One Philippe Pochet, "one of the founding partners of FTPA... seasoned practitioner with a proven track record in Intellectual Property and Media Law... particularly active in the fashion and cinema industries..." was CCed in Oger's email communications with BPA's Laplana.

And Pochet wasn't the last "seasoned practitioner with a proven track record" to partake with Salazar: someone self described as "Recognised as one of Europe’s leading innovators and investors...", someone who "has led successful ventures in Europe and North America. From real estate to merger arbitrage and hedge fund management", and who "understands how to maximise returns for investors", AND has a "commitment to transparency" was also part of Salazar money laundering activities. We refer to Jean-François de Clermont-Tonnerre.

Aside from BPA's Laplana, a true, blue-blooded Swiss bank with centuries-long expertise in money laundering (Hottinger & Cie) was used by Salazar to wire the proceeds of corruption around. This site sent request for comments to Oger and to Antoine Tchekhoff, another FTPA founder. Neither has replied.

Salazar was arrested for corruption in Venezuela. Please do ponder on somebody being arrested for corruption, IN Venezuela. Unconfirmed reports claimed Salazar had been freed recently. Ramirez, first cousin and main benefactor / beneficiary of Salazar's "business activities", is in chavismo's dog house, desperately trying to convince the world he is innocent. This site knows better.