UPDATED 07/01/2022 - 16:16GMT - Have a look at the pdf below. It is an internal memo from Grupo Financiero BOD, dated 18 October 2016, signed by none other than Victor Vargas, founder and CEO of the group. No watermark has been added to preserve orginal metadata (author Carely Valentin). It relates to banking operations in Venezuela and abroad (money transfers). Start in the first page, at "Desafortunadamente nuestro país ha sido incluido, de manera justa o injusta, en la lista de países denominados “MAJOR MONEY LAUNDERING COUNTRIES” que publica el Departamento del Tesoro de los Estados Unidos de Norteamérica (US DEPARTMENT OF THE TREASURY) y dentro de estos países ocupa los primeros puestos entre las denominadas “JURISDICTIONS OF PRIMARY CONCERNS”, por lo que los clientes venezolanos están sometidos a una vigilancia permanente y especial por los Oficiales de Cumplimiento de todos los bancos del mundo. Cada transacción es revisada de manera individual y debe pasar controles que no aplican para ciudadanos de otros países."

The memo is addressed to local and international regional managers and directors. Let us recall that, at one point, Vargas' financial group had, apart from Venezuela, banks and brokerage houses in Curaçao, Panama, Dominican Republic, and Antigua.

Fluency in Spanish isn’t needed to realize that "nuestro país" means Venezuela, and that "Oficiales de Cumplimiento de todos los bancos del mundo" means compliance officers of all banks around the world checking each transaction individually ("Cada transacción es revisada de manera individual").

Page 2 starts with "La mayoría de los clientes venezolanos, personas naturales y jurídicas, están en situación no cumplimiento según los parámetros de la “FINANCIAL ACTION TASK FORCE” de la Organización para la Cooperación y el Desarrollo Económico (OCDE), por lo que todas sus transacciones son especialmente monitoreadas y sometidas a requerimientos de información inusuales por los Oficiales de Cumplimiento de los Bancos Corresponsales."

Here, Vargas admits that most of his Venezuelan clients do not comply with OECD's Financial Action Task Force guidelines.

Vargas then adds:

"Se agrega a lo anterior el hecho de que Venezuela formó parte de la lista de las “HIGH RISK AND NON COOPERATIVE JURISDICTIONS” en materia de lavado y financiamiento del terrorismo y es de conocimiento público que ciudadanos venezolanos están siendo incluidos en la lista “SPECIALLY DESIGNATED NATIONALS” de la Oficina de Control de Activos Extranjeros (OFFICE OF FOREIGN ASSET CONTROL u OFAC), que implica la inmediata congelación de bienes y cuentas bancarias y la prohibición de transacciones con entidades (Bancos, Casa de Bolsa, etc.) y ciudadanos norteamericanos, por lo que ahora cuando un cliente venezolano ordena una transferencia, los Oficiales de Cumplimiento deben revisar si el ordenante está incluido en las listas actualizadas de la OFAC."

This is very interesting. While Vargas correctly mentions that Venezuela is in the “HIGH RISK AND NON COOPERATIVE JURISDICTIONS” when it comes to money laundering and terrorism financing, and that some Venezuelans have been designated to OFAC's SDN list, it is a stretch to say that compliance officers have to check whether Venezuelans ordering money transfers are in the OFAC list.

Vargas' very own son in law, Francisco D'Agostino, is an OFAC designated individual, yet he lives in Spain in the lap of luxury with Vargas' daughter and hasn’t suffered, in the slightest, due to OFAC designation. Same applies to Alessandro Bazzoni (D'Agostino's partner in crime), who not only continues to operate as normal in the UK, but is a shareholder in a Swiss bank (MBaer Merchant Bank), where his wife is a board member.

The next statement brings Vargas closer to his banks bread and butter:

"Otro problema importante que enfrentan las transacciones de nuestros clientes, es que algunos de ellos son Personas Expuestas Políticamente (PEP), o son familiares de estas personas, o han recibido transferencias en sus cuentas por parte de PEP, o han contratado con el Estado venezolano, lo cual los asimila a las PEP a los fines de los Oficiales de Cumplimiento. Si bien estas transacciones no son ilegales, la condición de PEP de alguno de los intervinientes en la transacción, podría someterla al escrutinio de la Comisión de Valores Norteamericana (SECURITIES AND EXCHANGE COMMISSION o SEC) y/o del Departamento de Justicia de ese país (US DEPARTMENT OF JUSTICE) por potenciales violaciones de la Ley de Prácticas Corruptas en el Extranjero (“FOREIGN CORRUPT PRACTICES ACT” o FCPA) si la operación no cuenta con una justificación económica plausible."

Vargas' clients, that is PEPs and their relatives, moving dodgy funds originated from State contracts?

And then, the money shot:

"Asimismo, otra situación significativa, atada a la misma legislación FCPA, es que la compra de dólares en el mercado “paralelo” o “negro” es una violación de los Convenios Cambiarios celebrados por el Ejecutivo Nacional y el Banco Central de Venezuela, así como de las normas especiales dictadas por este último, y resulta que esto es considerado por la FCPA como un delito federal en los Estados Unidos de Norteamérica. Por esa razón, cuando los clientes venezolanos no pueden justificar el origen de los fondos que reciben en sus cuentas o que envían a otras cuentas, y dado que la gran mayoría de las transferencias en dólares deben pasar el sistema financiero norteamericano, las transferencias respectivas podrían ser rechazadas. Esa es la razón también por la cual muchas cuentas de venezolanos en los Estados Unidos de Norteamérica y en otros países, han sido cerradas."

Translation, of bold part: USD purchases in the parallel / black market are in breach of foreign exchange agreements signed between the Executive and Venezuela's Central Bank, as well as specific guidelines established by the latter, and this is considered a federal crime in the U.S. under FCPA rules.

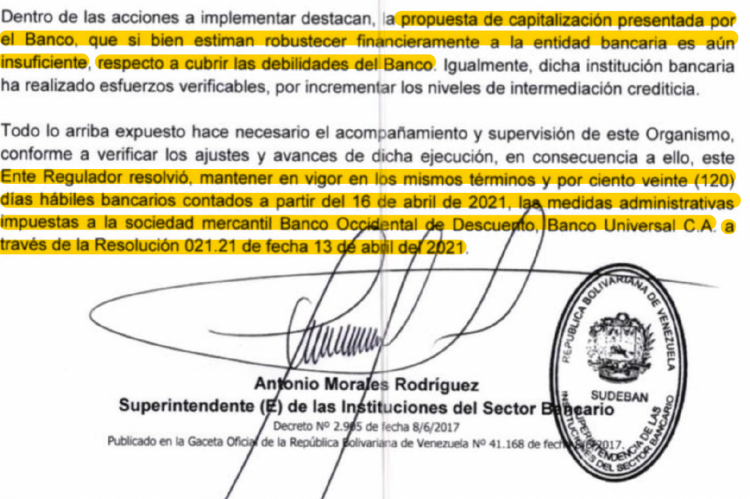

Vargas is, thankfully, deep in trouble. Nearly all branches of his money laundering group have been intervened by regulators in the different jurisdictions where he operates. Even in Venezuela, unquestionably the Western Hemisphere's corruption mecca. Decades of irresponsible spending in an obscene lifestyle makes pretty much impossible that the USD 755,630,442.59 that Vargas owes will ever be recovered.

His candour, in this private memo to his employees, confirms that he's been aware, all along, that his operation was illegal, that he was dealing with PEPs, that it would be impossible for most of his clients to justify legitimate origin of the funds he was helping launder and move around. But beyond fact that Vargas himself is a government contractor, and (for many years) one of the largest players in Venezuela’s black market, his peccadillo was to misappropriate clients' funds. When a large proportion of clients are PEPs and thugs that happen to control the State, and are involved in all manner of criminal activity, stealing from them can have dire consequences.

Vargas is still manoeuvring, desperately trying to keep his head above water. In our view, it is a question of when, not if, he'll meet his due.

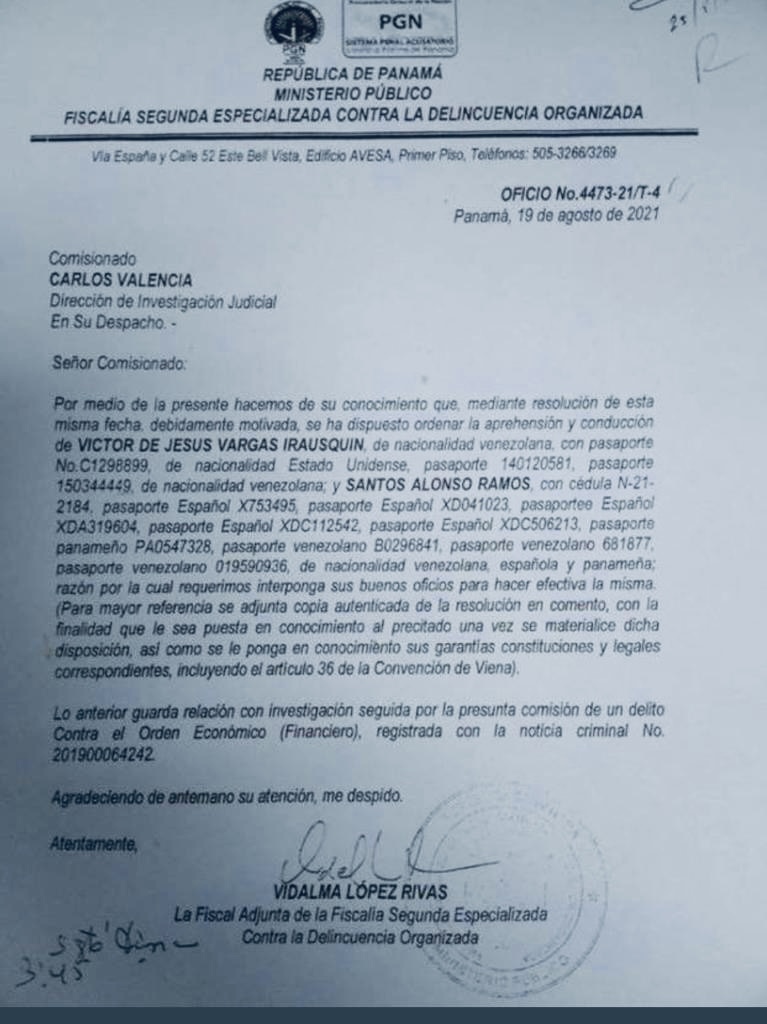

UPDATED 07/01/2022 - 16:16GMT: sources reminded us of a couple of aspects that weren't mentioned. First, Victor Vargas remains wanted in Panamá, where another one of his money laundering joints was raided recently.

Sources in Panama report that authorities raided #Investrading, which was Victor Vargas’ back office for all of his corruption in the Caribbean.

Guess desperate search for funds to pay narcogenerals continues… Cc @BODoficial

— Alek Boyd “Plagiarism is theft” (@infodi0) December 17, 2021

Sources reported that Vargas tried to move ops to a vehicle called National Leasing and Financial Corp. Still in Panama, there's that involvement of Dinosaur Merchant Bank on Vargas' related issues...

Then we have the very public resignation of Marcos Juan Troncoso Mejía, former board member of Banco Múltiple de las Américas, S.A. (Bancamérica), Vargas bank in the Dominican Republic. Troncoso Mejía accused Vargas of keeping -from the board- involvement of Dominican Republic's Superintendency of Banks in day-to-day monitoring / supervisory roles. The Superintendency appointed José Ricardo López Faña to dive into Vargas' DR bank operations, and specifically to check Bancamérica $25 million deposits into BOI Bank, an Antiguan bank -also intervened- part of Vargas' group.

Bancamérica remains under watchdog's supervision since. It last published audited accounts in 2018. People familiar with Vargas operations have reported that meetings have been held with the Superintendency, with the aim of saving Bancamérica, despite multiple fraud allegations, lawsuits and regulators' interventions in Venezuela, Curaçao, Panama and Antigua.